FX CFD VIEWS

Disclaimer : This is not an investment advice.

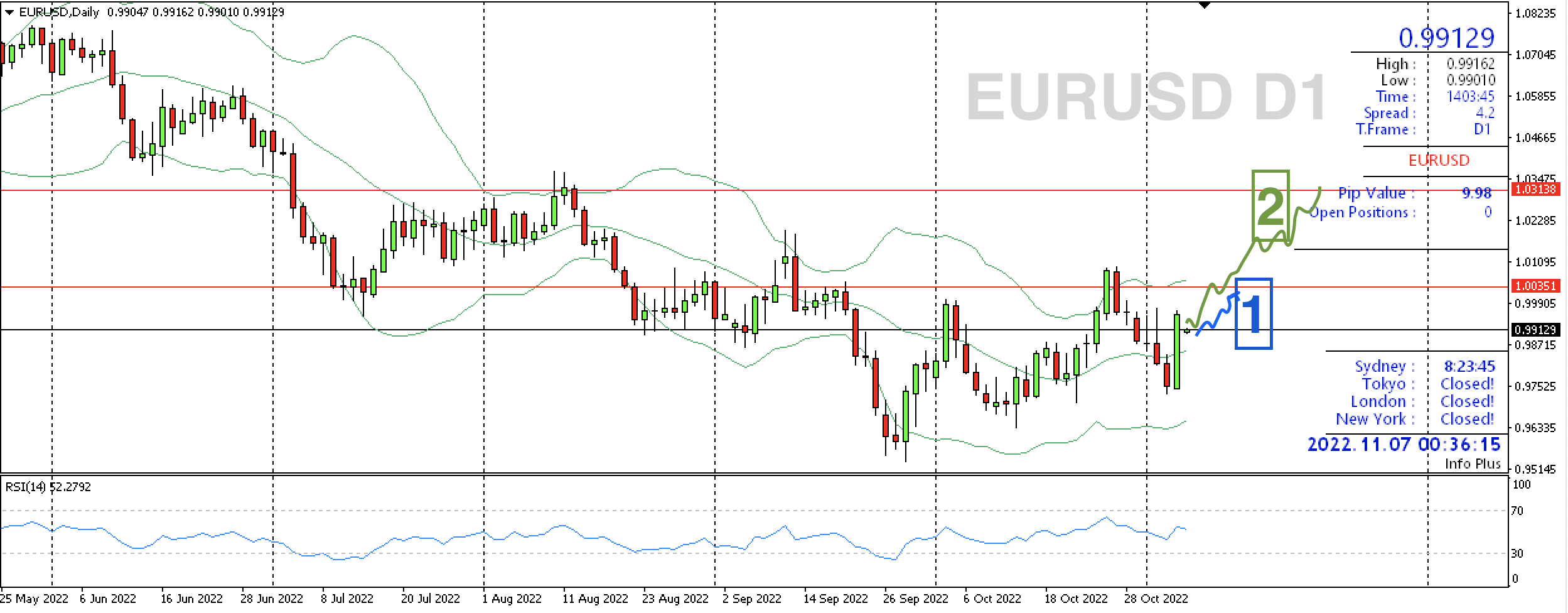

EURUSD D1, Can the rebound be sustained, Fed rates …

November 07 2022 – After latest Fed rates, the dollar started to drop signaling a possible bigger correction that could send the EURUSD pair higher with targets 1.0035 (1) or even higher to 1.0313 (2). But must be careful because the dollar correction can be smaller than expected.

EURUSD D1, The downside pressure could continue

August 13 2022 – Difficult to see the pair going much higher. The downside pressure can continue. If the pair goes up a little bit more, that would be most likely a new point to SELL.

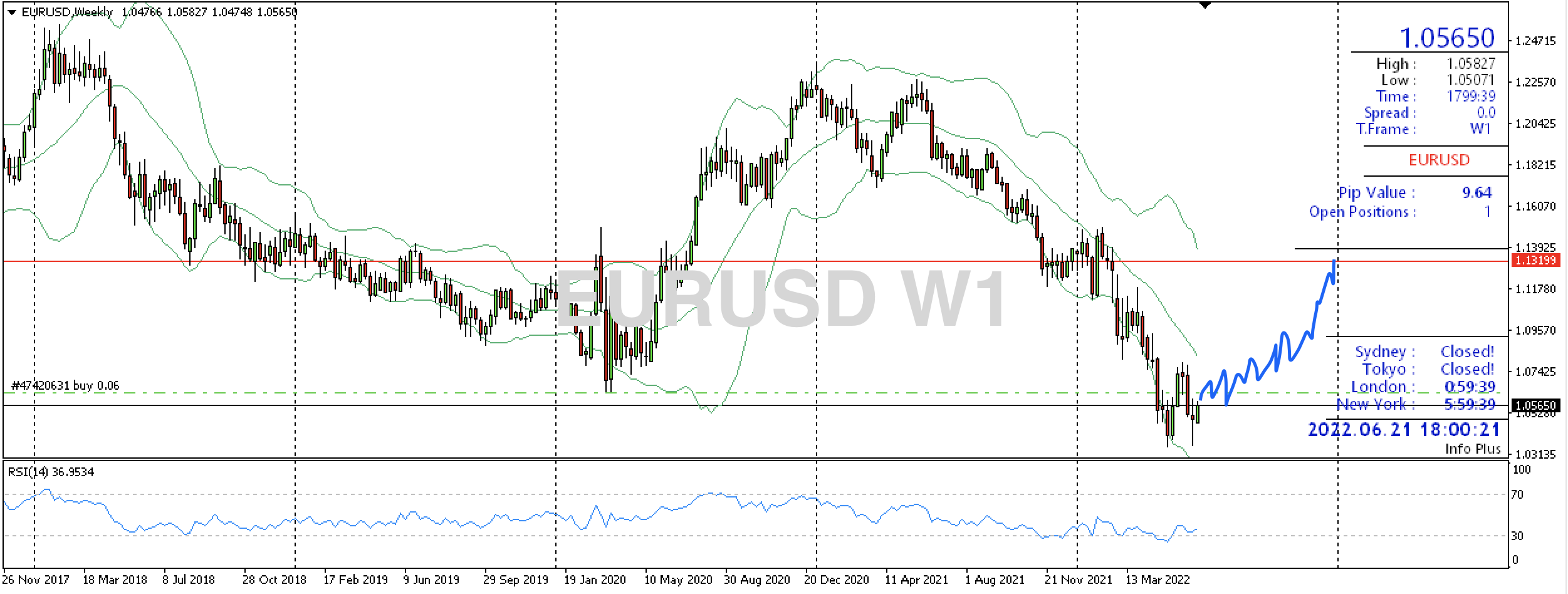

EURUSD W1, long term, heading to 1.13 ish, possibly

June 21 2022 – The pair could be possibly now touched the bottom and slowly heading to 1.13 which could be hit by the end of the year or Q1 2023. Despite the expected Fed rates, the dollar could experience the so waited weakness. ECB rates could also push the pair, upside.

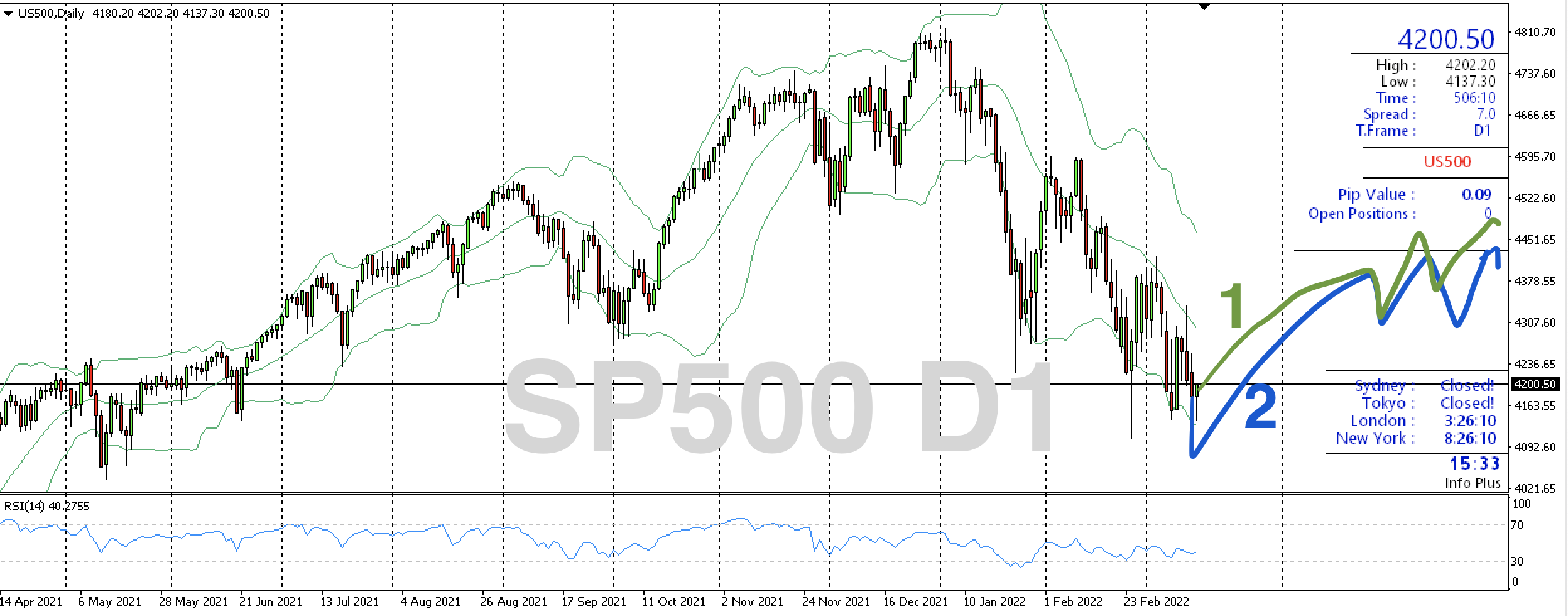

Nasdaq, SP500 W1, Inflation Concerns, Fed Rates

June 20 2022 – Buying the dip is not the call to make right now. With inflation concerns and the Fed announcing more rate hikes, and time for “summertime”, we could see deeper move in the following weeks. Caution necessary and lot of patience. Not a time to buy.

Nasdaq, SP500 D1, The Buy is Coming this week

Mar. 15 2022 – The Russia – Ukraine situation is not affecting the markets that much. Fed rates expected to be raised this week. As markets looks already priced, the rebound could begin, but possible to stay in range (on the upside though). Likely time to buy.

Nasdaq, SP500 D1, Technical Reboud after Correction

Jan. 22 2022 – Correction happened as stated on previous post. A technical rebound is expected this coming week. Buy positions likely moving SL to Breakeven when possible as Indices are not yet out of the woods. Fed rates are still to come. Scenario 1 (red) most likely.

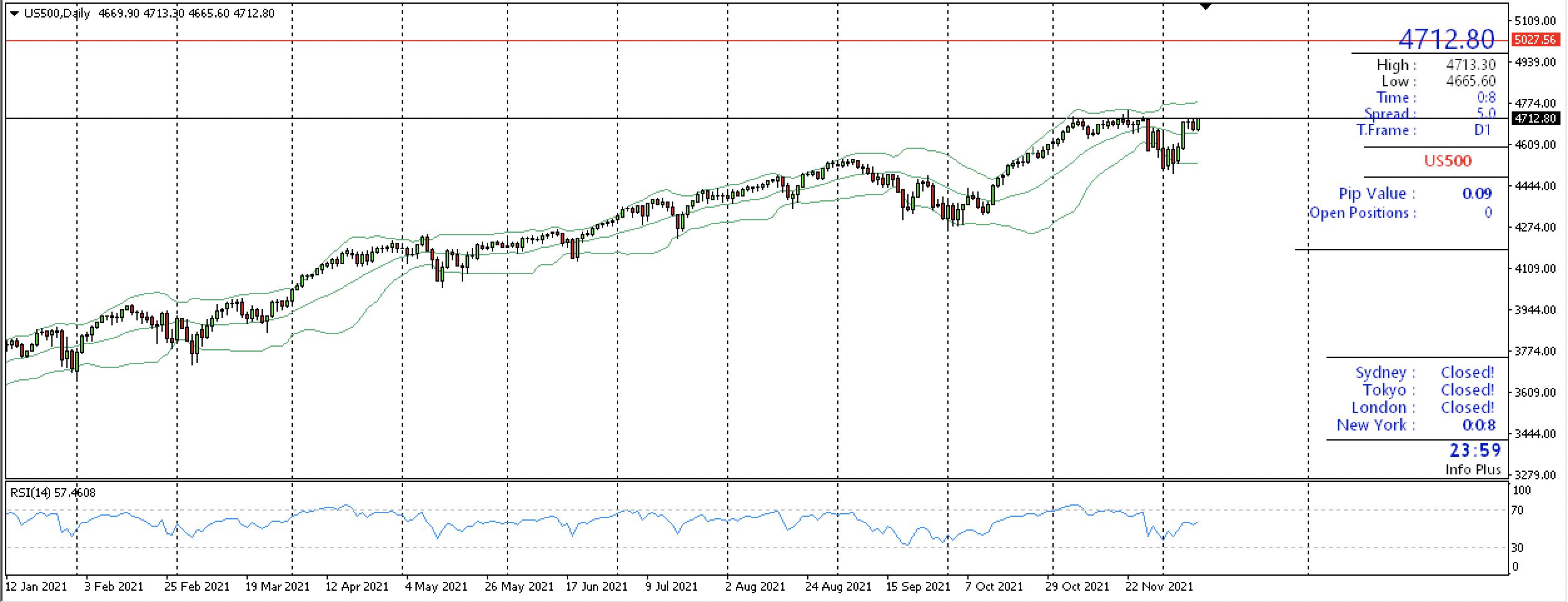

SP500, Correction before a sustained upside

Jan. 09 2022 – Fed tightening, moderate growth, but 2022 outlook remains positive, possibly at slower pace than 2021. Looking for buybacks on Q1 and worse case in Q2. Targets between 4900 – 5300 prices marks.

Gold, The Upside Remains on this Q4-21 and Q1-22

Dec. 13 2021 – Inflation, Fed tapering … the metal remains on the buy side as for now. A majority is seeing gold hitting the 1900 price mark sometime soon. Must stay cautious with gold anyway, can turn direction.

SP500, Pullback if Any, But Upside can Continue

Dec. 10 2021 – US Interest Rates next week on Wed. 15th, small pullback if occurs, assuming a no change from Fed, and head up searching for a new All Time High. Index could be touching the 5000 mark by the end of year or January.

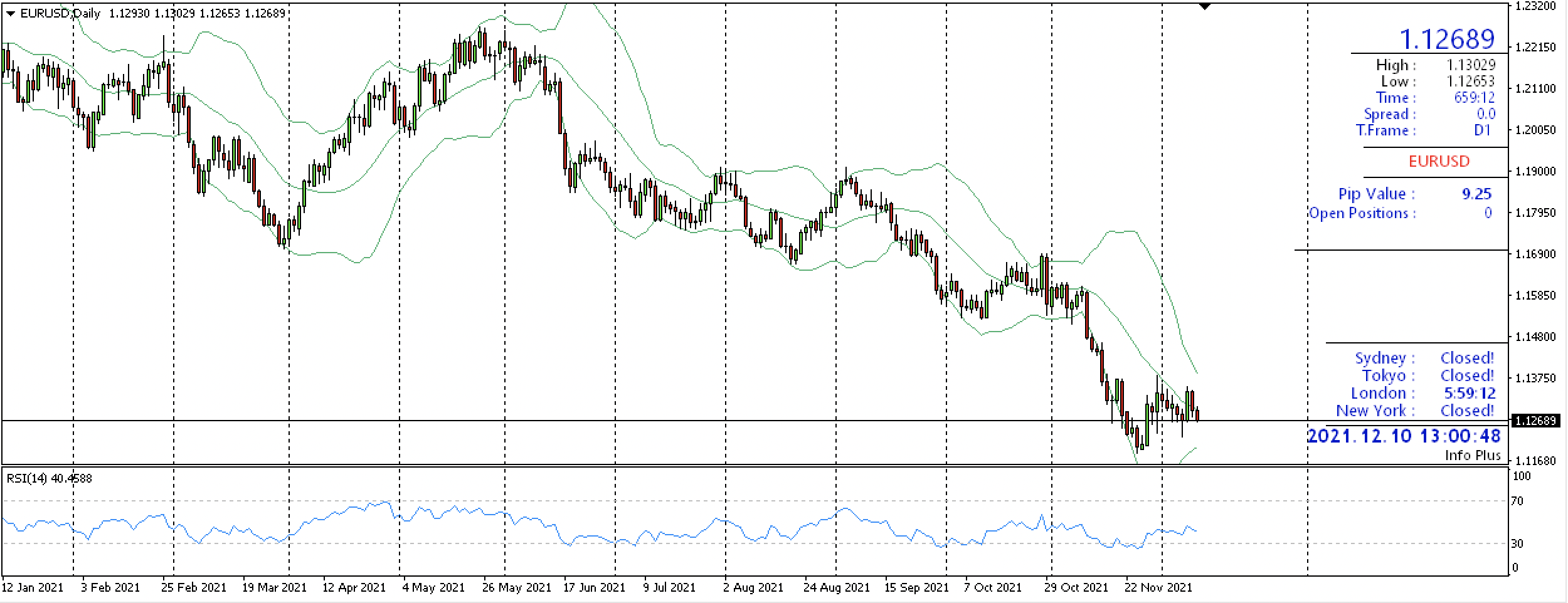

EURUSD Forecast Q4-21, Q1-22, Downside Persists

Dec. 10 2021 – With usual pullbacks and news reactions in the process, the pair could continue to be pushed to the downside Q4-21, Q1-22, we will have to see at that time if the US dollar will continue on the strong side. Euro looks weak next year. Pair could be hitting 1.10 or lower in the near future.

NEWS

December 3, 2021 :

Site upgrading.

Data is safe and well backed up and continue working normally.

DISCLAIMER

The content of this website does not constitute investment advice nor an offer for sale nor a solicitation of an offer to buy any product or make any investment.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. JAVIERYEP.COM does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in the markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this website are those of the authors and do not necessarily reflect the official policy or position of JAVIERYEP.COM nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

JAVIERYEP.COM and the authors do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. JAVIERYEP.COM and the authors will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The authors and JAVIERYEP.COM publish their opinions and views but nothing in this website is intended to be investment advice.